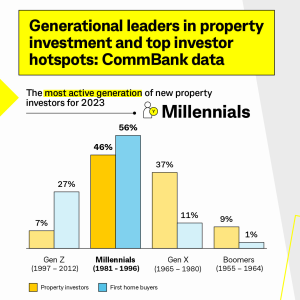

Almost 1 in 2 new property investors are millennials, beating the stereotype that they have a penchant for financial frivolity that prioritises lifestyle over financial milestones.

Data from CommBank shows millennials accounted for 46% of new property investors in 2023, surpassing Generation X and setting new trends in the property market with many millennials choosing to invest independently, without partners or family co-signers, and doing it with a lower average loan balance than their generational peers.

Source: CommBank, 2024

Despite changing economic conditions, the appetite for direct property investment remains as strong as the Australian pastime of wondering what they sold for down the street. Adam Youkhana, General Manager at Viridian Advisory mentioned, “This trend is most evident in Sydney, Melbourne, and, to a lesser extent Brisbane, where upper quartile values led the 2023 upswing through the first half of the year.”

According to the team at Smartmove, the specialist lending service of Viridian Financial Group, millennials today are better informed financially, thanks to easy-to-access resources like podcasts and social media. This may contribute to a hunger and understanding of how to leverage real estate investments.

Meanwhile, post-pandemic productivity shifts stated in RBA’s article on work routine have also allowed greater flexibility and, for some, an increase in savings, which has provided the capital needed to invest. These, paired with government incentives such as First Home Buyers Grants and tax concessions such as negative gearing and capital gains tax discounts, make real estate an alluring financial strategy.

Many are adopting the strategy of “rentvesting” – investing in more affordable areas while continuing to rent in CBD’s such as Sydney or Melbourne. This method allows them to balance lifestyle aspirations with a pragmatic approach to investing, a win-win without compromising their standards of living.

However, the strategy is not without its hurdles. With high cost of entry and the recent upticks in interest rates, add layers of complexity to this strategy. Nevertheless, millennials are navigating these waters with a mix of caution—their average investment loan is around $528,000, which is less than the $624,000 for typical home buyers.

Millennials are not setting a trend; in many ways, they are becoming the game-changers in the Australian property market. As this generation continues to invest and innovate, the ripple effects will be felt across the entire economy, setting new norms in property ownership and investment strategies.

For those interested or considering their own foray into property investment, it’s essential to make decisions that align with your personal goals and objectives, rather than trends. Engaging with a knowledgeable adviser or broker will provide you with tailored advice and assist you in accessing finance, navigating government incentives, and ensuring your investment choices support your long-term objectives.