In many Australian households, there’s a quiet but significant gap when it comes to super balances. Often, this gap stems from instances where one partner has stepped back from their career or shifted to part-time work to juggle family responsibilities. This imbalance is more than just a snapshot of who earns what—it casts a long shadow over future plans, affecting how securely both partners can step into their retirement years.

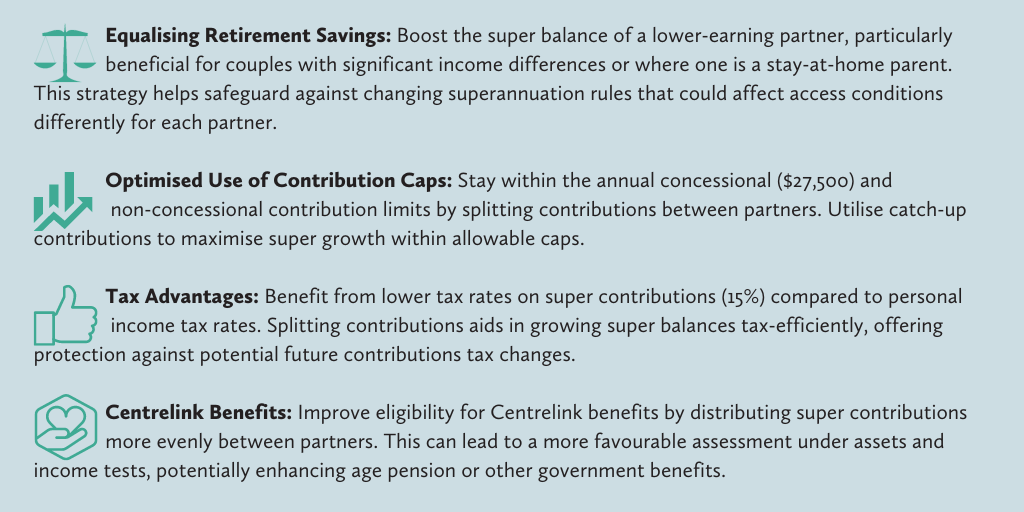

Bridging this gap is essential, not just for the sake of fairness but for the peace of mind that comes with knowing retirement can be enjoyable and worry-free for both. This is where strategies like super contribution splitting come into play. Far from a mere shuffling of assets, it’s a strategic dance of giving and growing, aimed at maximizing the retirement benefits for both partners. Let’s delve into this concept, understanding why it’s done, how it can be done, and ultimately, its benefits.

The Strategic ‘Why’ Behind the Split

The rationale behind super splitting is multifaceted. Financial Adviser Shane Fisher states that “contribution splitting strategy is an alternative strategy that gets often overlooked because it isn’t a one-size-fits-all affair.” However, it can be a valuable proactive strategy to implement to reap the benefits down the line.

The Strategic ‘How’ to Split

Superannuation contribution splitting encompasses the transfer of concessional contributions, including employer and salary sacrifice contributions, from one partner to another, or alternatively, making direct, non-concessional (after-tax) contributions to a spouse’s super. This strategic move not only facilitates the sharing of retirement savings but can also offer tax advantages, such as potential tax offsets for direct contributions.

Super contribution splitting strategy, with its blend of financial foresight and mutual support, isn’t just about numbers; it’s about planning a future together that’s as secure and fulfilling as possible.

Navigating this path requires understanding the nuances, from eligibility to the timing of contributions. It underscores the importance of strategic financial planning and professional advice.

To discuss how you can maximize your benefits as a couple and your retirement plan, book a time to speak with your adviser before the end of this financial year.